Investing

Explore the Climate Transition Global Equity Opportunity

A diversified global equity portfolio positioned for the transition to a decarbonised economy.

Designed to deliver both financial and climate outcomes

Part of Allspring’s US$5.8 billion climate transition suite, Allspring (Lux) Worldwide Fund—Climate Transition Global Equity Fund is a diversified global equity portfolio with a dual objective of targeting long-term capital appreciation—excess returns versus the MSCI ACWI—and reaching net zero by 2050.

We believe that identifying climate transition winners does not mean solely investing in the low-carbon companies of today, but rather in companies that should win in a low-carbon world of tomorrow.

We use forward-looking assessments of climate positioning to identify these companies and capture opportunities presented by the transition to a decarbonised economy.

Our approach blends quantitative tools with fundamental insights designed to deliver both financial and climate outcomes in a core global equity portfolio.

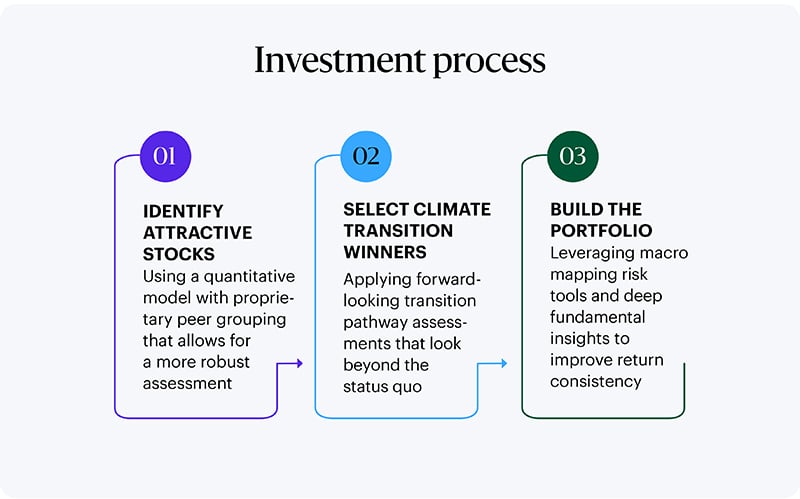

Our Climate Transition Global Equity investment approach seeks to:

01. Drive returns through an innovative bottom-up stock selection approach combining the best of quantitative models with fundamental insights

02. Capture opportunities by investing in climate transition winners

03. Deliver consistent returns through an explicit focus on avoiding unintended risks

04. Provide a well-diversified core global equity portfolio designed to avoid style biases

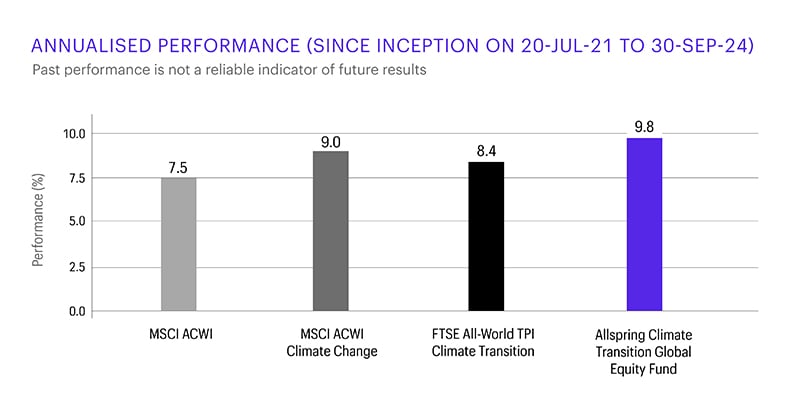

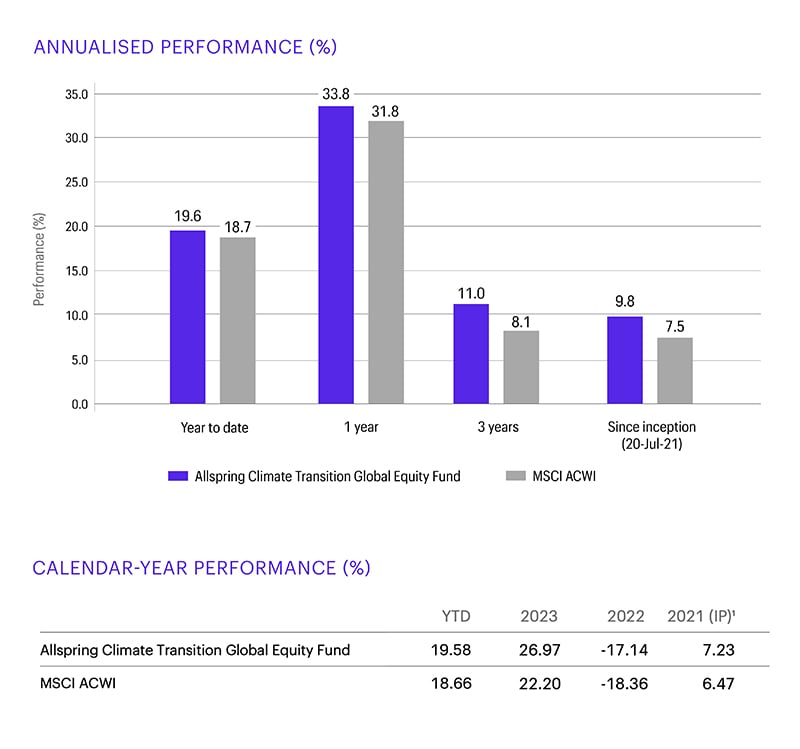

Climate investing: A track record of delivering returns

Source: Allspring, Bloomberg. Data shown is for Allspring (Lux) Worldwide Fund—Climate Transition Global Equity Fund Class I USD. The Fund uses the MSCI All Country World Index as a reference for selecting investments and for performance comparison. The investments of the fund may deviate significantly from the components of and their respective weightings in the benchmark. The benchmark index is not consistent with the environmental or social characteristics promoted by the Sub-Fund. ¹For the period 20 July 2021 to 31 December 2021. Performance calculations are net of all applicable fees and are calculated on a NAV-to-NAV basis (with income reinvested). Performance shown is for class and currency indicated and returns may increase/decrease as a result of currency fluctuations.

Peer group percentile ranking*

3rd

Percentile

Year to date

1st

Percentile

Over one year

1st

Percentile

Since inception

*Source: Morningstar. Data shown is for Allspring (Lux) Worldwide Fund—Climate Transition Global Equity Fund Class I USD (formerly Allspring (Lux) Worldwide Fund—2 Degree Global Equity Fund) as at 30 September 2024. The Morningstar absolute ranking is based on the fund’s total return rank relative to all funds that have the same category for the same time period. Morningstar rankings do not include the effect of sales charges. Past performance is not a reliable indicator of future results.

Featured insights

Learn more about the fund

Visit the fund page for performance, deeper investment details, and fund documents.

Also in our climate transition suite—fixed income funds. Learn more:

Key risks

Currency risk: Currency exchange rates may fluctuate significantly over short periods of time and can be affected unpredictably by intervention (or the failure to intervene) by relevant governments or central banks, or by currency controls or political developments.

ESG risk: Applying an ESG screen for security selection may result in lost opportunity in a security or industry resulting in possible underperformance relative to peers. ESG screens are dependent on third-party data and errors in the data may result in the incorrect inclusion or exclusion of a security.

Smaller-company securities risk: Securities of companies with smaller market capitalisations tend to be more volatile and less liquid than securities of larger companies.

Global investment risk: Securities of certain jurisdictions may experience more rapid and extreme changes in value and may be affected by uncertainties such as international political developments, currency fluctuations and other developments in the laws and regulations of countries in which an investment may be made.

Emerging market risk: Emerging markets may be more sensitive than more mature markets to a variety of economic factors and may be less liquid than markets in the developed world.

Leverage risk: The use of certain types of financial derivative instruments may create leverage which may increase share price volatility.

© 2024 Morningstar. All rights reserved. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.