Capabilities

Remi

Access new possibilities with tax-advantaged, personalized separately managed accounts—purpose-built to elevate the investor experience. Tax efficiency, customization, cost-effectiveness, multi-asset capabilities, and Allspring's expertise come together in one investment solution.

SMA benefits

Putting the SMArt in SMAs

Tax management

Customized SMAs provide direct ownership of individual securities, enabling strategies like tax-loss harvesting and tax optimization.

Personalization

SMA strategies provide flexibility with investment choices and can evolve with changing market conditions and investor wants, needs, and goals.

Seamless transitions

Legacy portfolios can move to tailored solutions in a transparent, risk-aware, and tax-efficient manner.

Multi-asset capabilities

Remi provides multi-asset portfolio solutions, including direct indexing options, municipal bond ladders and multiple accounts per strategy.

Institutional trade execution

Remi leverages an efficient ecosystem to create scale for trading, which can potentially reduce costs for advisors.

Differentiated client experience

Allspring’s SMA ecosystem combines seasoned investment professionals with dedicated product and specialist teams to elevate the client experience.

Join the evolution

$73B

Total managed account assets

Inclusive of assets under advisement.

12th

Largest SMA provider

Among all firms providing managed account offerings. Source: Cerulli Edge, 4Q 2024.

57

Investment strategies

As of December 31, 2024, unless otherwise noted.

What can Remi unlock for you?

Learn how Remi is designed to help meet the individual needs of each investor while unlocking smart outcomes for all.

Transcript

Announcer: Every financial advisor knows that every investor is different. Different passions, different priorities leading to different opportunities. How can you truly tailor portfolios to each client and unlock smart outcomes for all? Meet Remi. Remi is Allspring's intelligence solution for personalizing separately managed account portfolios, powered by technology, research, and human insights. Remi helps you realize more potential for each client with smart outcomes driven by smart features. Smart possibilities. Your clients are unique. We work hand in hand with you to tailor each portfolio's goals and tax preferences. Smart technology. Remi's portfolio construction engine, backed by our fundamental research team, simplifies transitions and tax management to deliver a portfolio personalized for each client. Smart portfolios. Purpose built around investor values, Remi drives more meaningful outcomes by intelligently adapting to reflect the person behind each portfolio. Remi lets you reimagine how you achieve success that's meaningful to each and every client. Tailor-made portfolios. Far-reaching possibilities. Smart outcomes. That's Remi.

Custom proposals

Choose how to receive a free transition proposal

1.

Unlock the power of Allspring SMA strategies

Select the strategy that fits a portfolio’s objectives. Access Allspring SMA strategies with the tax-advantaged, customizable, and personalized features through the intelligent Remi ecosystem.

2.

Let Remi provide you with a custom client proposal

Log In now or request portal access for Remi to input client-specific preferences and choose from broad customization options—to generate a tailored investment proposal.

3.

Contact your dedicated SMA specialist

Meet the Allspring Team designed to empower financial advisors and their clients to invest for smart outcomes and refine the optimal customization options for each portfolio.

Robust tax management

Access systematic, year-round tax-loss harvesting

Seize opportunities to proactively manage portfolios according to client needs, not just at the end of the year.

Leverage tax-lot-level decision-making

Exercise control over individual tax lots using our powerful and proprietary tax management technology.

Mitigate tax erosion

Access a full range of strategies to help enhance after tax returns through ongoing tax management and tax-loss harvesting.

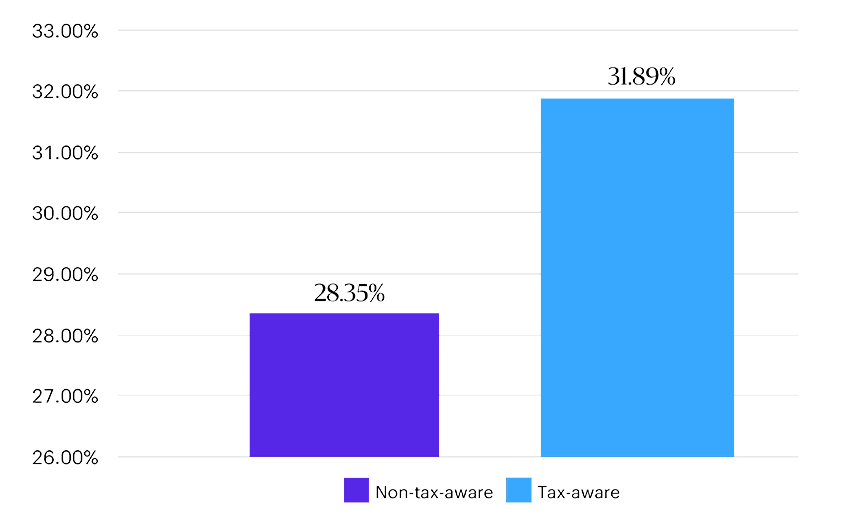

Hypothetical portfolio returns after 10 years

In this hypothetical example, over 10 years, a client with a $1 million portfolio could increase annualized after-tax returns by 3.54% in total. (After tax, post-liquidation.)*

*This chart and the results shown are hypothetical and for illustrative purposes only and do not represent any product managed by Allspring Global Investments. The charts are intended to serve as a general example of a portfolio of municipal bonds with an initial investment of $1,000,000, expected annual total return of 6.7%, expected annual turnover of 30%, coupon rate of 3.8% , short-term tax rate of 40.8% and long-term tax rate of 23.8%. Tax-aware portfolio values and returns reflect the deductions of tax loss. Non-tax aware portfolio values and returns do not reflect the deduction of tax loss.

Personalized customization

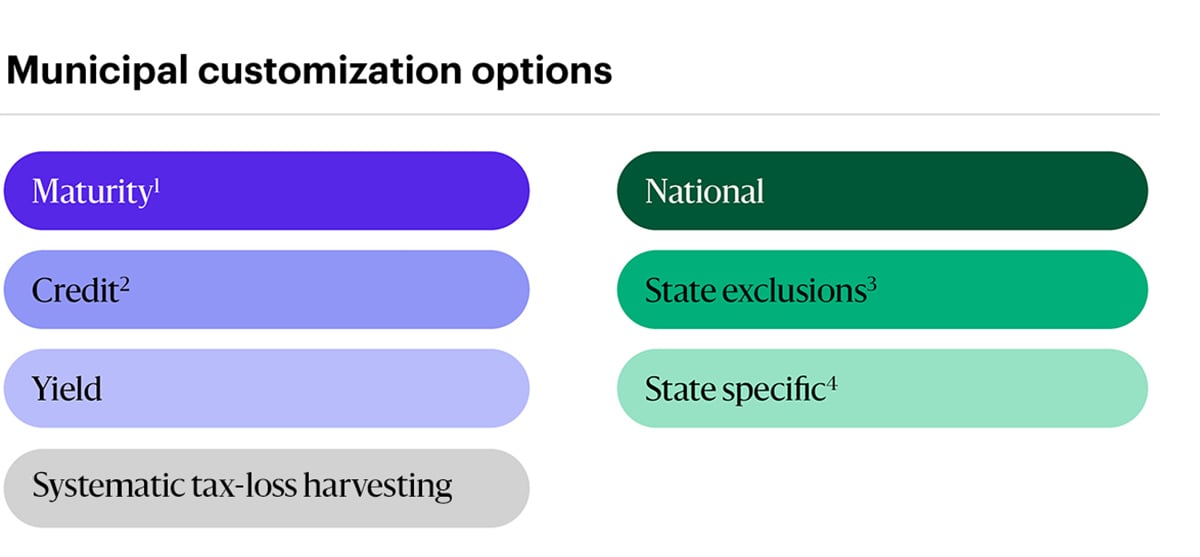

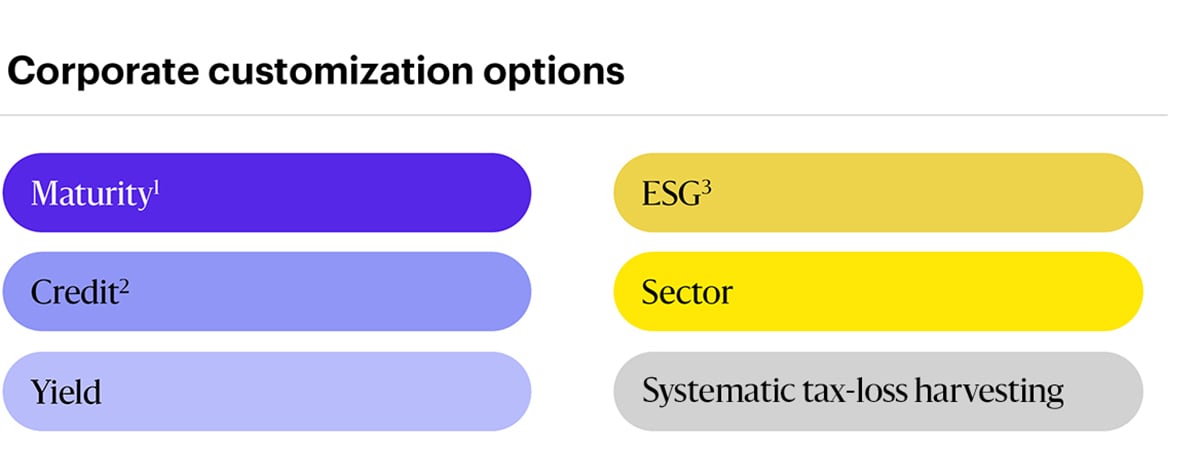

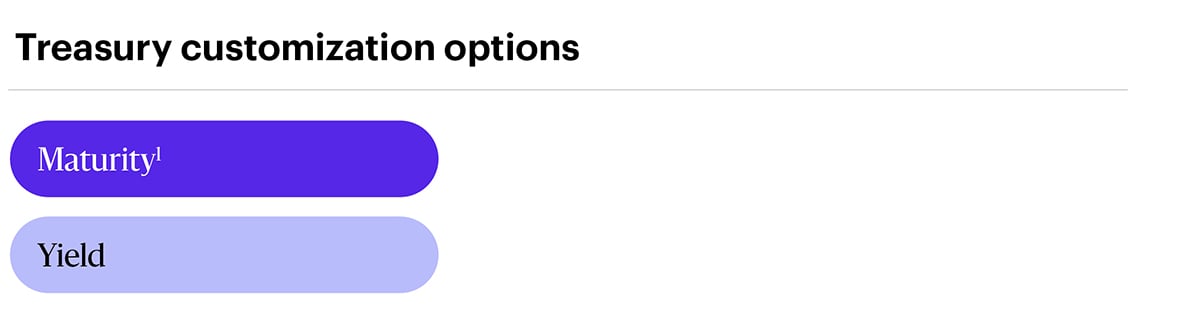

Tailor fixed income portfolios

Design bond portfolios according to your own personal preferences including municipal, corporate, and treasury bond ladder options with multiple customization possibilities focused on maturity, yield, credit, sector, ESG, state, and more.

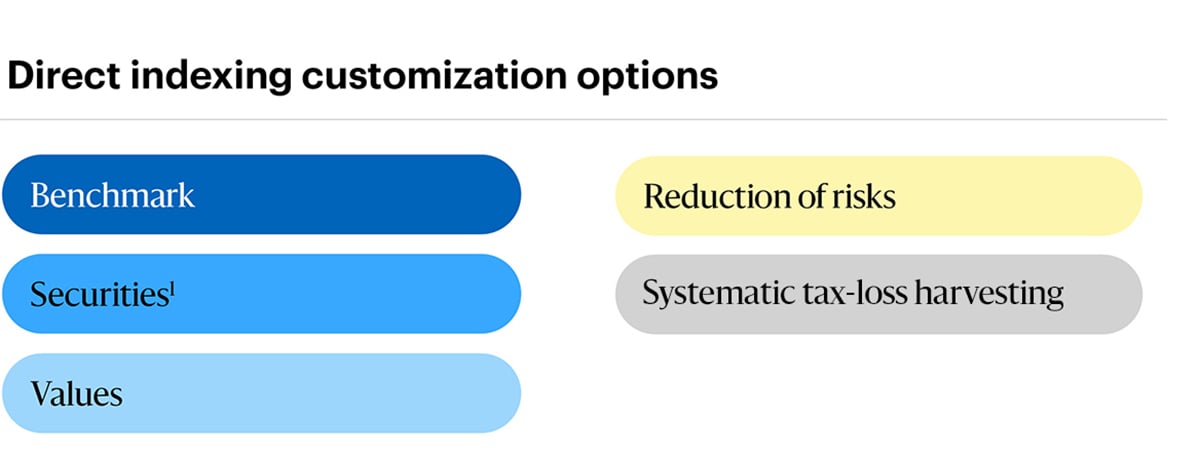

Customize equity exposures

Utilize Remi’s Directing Indexing capabilities to create personalized equity portfolios with individual stock and industry group customization options.

Access Allspring’s active management

Leverage Allspring’s active expertise with Remi’s CoreBuilder series—offering the compelling combination of mutual fund investing with the unique features of a separately managed account.

Simplified transition planning

Streamline the process

Remi helps make the transition process seamless, ensuring legacy portfolios move to customized solutions in a risk-aware, tax-efficient manner—allowing clients to see the impacts of exposure changes in advance.

Create value up front

Pinpoint yield-increasing opportunities, harvest losses strategically to counterbalance taxes, and define duration and credit profiles at the onset.

Emphasize tax efficiency, tracking error, or both

You are in control with Remi. Choose to minimize tax liabilities, the impact of tracking error, or a combination of both. The choice is yours.

The blueprint to a smart transition

Fixed Income: A selection of customizable solutions

For illustrative purposes only.

- Customizable within each shell.

- Customization is limited to strategies with the ability to exclude ratings and/or add minimum or maximum weights.

- Limited to national strategies.

- State specific targets 50% of total portfolio.

For illustrative purposes only.

- Customizable within each shell.

- Customization is limited to strategies with the ability to exclude ratings and/or add minimum or maximum weights.

- Companies are categorized into three buckets based on their ESG rating: leaders (AAA–AA: a company leading its industry in managing the most significant ESG risk and opportunities), average (A– BB: a company with a mixed or unexceptional track record of managing the most significant ESG risk and opportunities relative to industry peers), and laggards (B–CCC: a company lagging its industry biased on high exposure and managing the most significant ESG risk and opportunities). There are three ESG preferences currently offered (from strictest to least restrictive): i. A or better (highest emphasis with exclusion of all "laggards") ii. BBB or better (moderate emphasis with exclusion of "laggards") iii. BB or better (exclusion of most egregious "laggards", i.e., those B and below).

For illustrative purposes only.

- Customizable within each shell.

Equity: A selection of customizable solutions

For illustrative purposes only.