Capabilities

Systematic Investing

Allspring’s Systematic Edge team is a quantitative, research-centric investment capability that meets client needs by delivering innovative products and bespoke solutions across alpha, target outcome, and liquid alternative strategies.

Explore core beliefs

Giving clients a systematic edge for better outcomes

Founded on research

Research is at the core of our investment insights and is holistically integrated across the platform.

Specialized insight

We deliver specialized insight into portfolio construction techniques and diversified philosophies to help provide targeted outcomes.

Continuous innovation

Striving to deliver the best outcomes to clients fosters a culture of continuous evolution.

Outcome-based capabilities center on investor needs

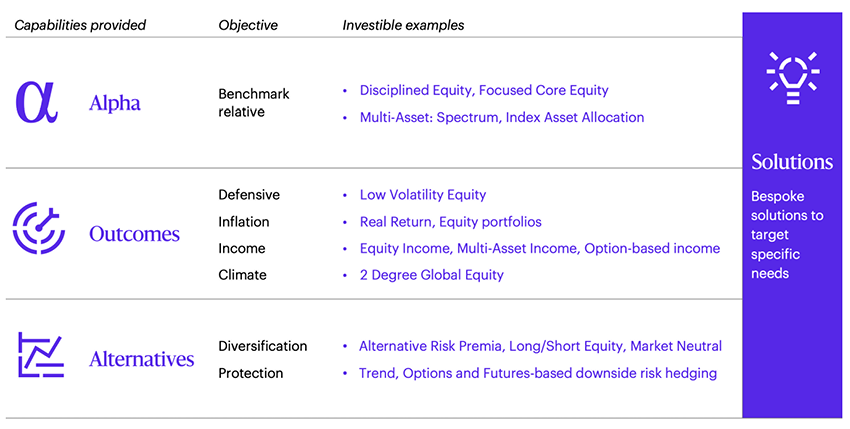

Collectively, the Systematic Edge team delivers innovative solutions across three outcomes—alpha, target outcome, and liquid alternatives. We leverage these capabilities to offer innovative products and tailored investment strategies to meet specific investor outcomes.

Alpha

We aim to deliver alpha across all market environments through a variety of different benchmark-relative strategies, such as Disciplined Equity and Index Asset Allocation.

Outcomes

We pursue compelling performance through exposure to a particular investment theme or outcome, including income, low volatility, inflation sensitive, and climate transition.

Alternatives

We seek diversification or protection in the form of liquid alternatives through an array of strategies, including Alternative Risk Premia, Long/Short Equity, and options and futures-based hedging.

Collectively, the Systematic Edge team delivers innovative solutions across three high-level categories—alpha, target outcome, and liquid alternatives. Each capability offers tailored investment strategies to meet specific investor outcomes.

Capabilities spotlight

Global Equity Enhanced Income

Features

- Two components (equity + options) are dynamically managed to balance the trade-off between income and capital growth.

- The investment process blends quantitative tools and fundamental analysis, resulting in a well-diversified/balanced high-yielding equity portfolio.

- Actively managed options use proprietary models to enhance income while preserving potential upside.

Why?

- It delivers enhanced income and long-term capital growth, targeting high consistent yield (6% p.a. since inception).

- It combines a high-yielding equity portfolio and actively managed options overlay to meet objectives.

- Balanced exposures explicitly seek to avoid style biases and structural underweights common in equity income strategies in order to mitigate style swings while capturing growth opportunities.

Discover our platform

Elevating client solutions through integrated research and portfolio construction

Research

The Systematic Edge team employs an integrated process whereby portfolio managers both conduct and implement research to facilitate continuous innovation across asset classes.

Equity

The Systematic Edge – Equity team's active approach to systematic factor-based investing is founded upon decades of quantitative research. Dynamic alpha models are combined with multi-dimensional risk management and unique portfolio construction to enhance client returns. Meet The Team

Fixed income

The Systematic Edge – Fixed Income and Custom SMA team leverages a factor-based, systematic process to deliver customized solutions for investors targeting specific outcomes. Meet The Team

Multi-asset

The Systematic Edge – Multi-Asset team is underpinned by a consistent investment philosophy and process that combine its strong heritage in quantitative investing with skillful portfolio design, dynamic allocation, and tactical tilts to achieve client objectives. Meet The Team

Options

The Systematic Edge – Options team believes that options-based strategies offer a number of positive attributes not always found in alternative investments. Meet The Team

Investment solutions

The Systematic Edge – Investment Solutions team is committed to delivering exceptional, customized investment solutions. The team concentrates on achieving client objectives and exceeding desired outcomes, or “outcome alpha”. Meet The Team

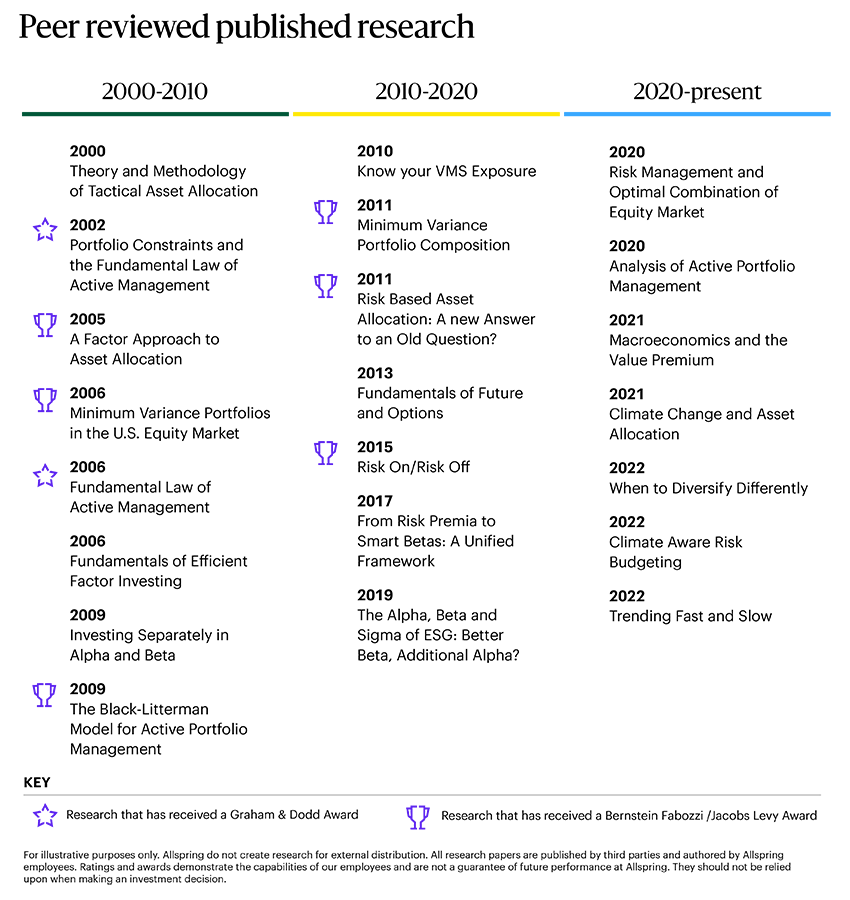

A history of award-winning research

The Systematic Edge platform is founded on a research-centric process that’s driven by a team of 65 professionals closely collaborating to deliver target outcomes.

Eddie Cheng

Portfolio Manager

Read our insights