Funnel Cakes, Carnival Rides, and Municipal Bonds

The market volatility following “Liberation Day” drove municipal yields to levels not seen since the Global Financial Crisis, presenting real opportunities for investors.

Key takeaways

- Nicholos Venditti, head of Municipal Fixed Income, explains the opportunities that recent roller-coaster-like market volatility has provided for municipal bond investors.

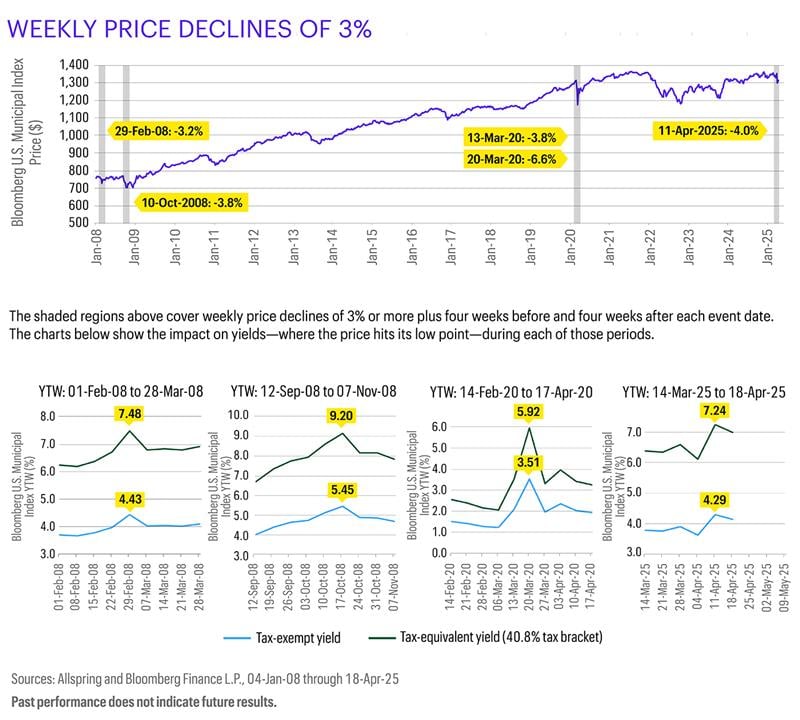

- In previous periods when U.S. municipal bonds experienced 3% or larger weekly price declines, they were met with a rapid increase in yields available to investors.

Funnel cakes. Also, nachos. And, to be honest, how do you pass up the soft-serve ice cream? As a 10-year-old, I lived for the Colorado State Fair and all the treats that filled the boardwalk. That summer, though, I had a different mission: Conquer The Ring of Fire. The upside-down roller-coaster that terrified and captivated me for as long as I could remember.

The outcome? Less triumphant. Most of the carnival food made a dramatic and unfortunate exit (details best left to the imagination). Like any 10-year-old, I rallied quickly. I didn’t view the experience as a disaster, but as an opportunity to replenish what I lost with another funnel cake. This time with extra powdered sugar.

The Ring of Fire was the wildest ride I’d experienced—until “Liberation Day” on April 2 sent fixed income markets into a tailspin.

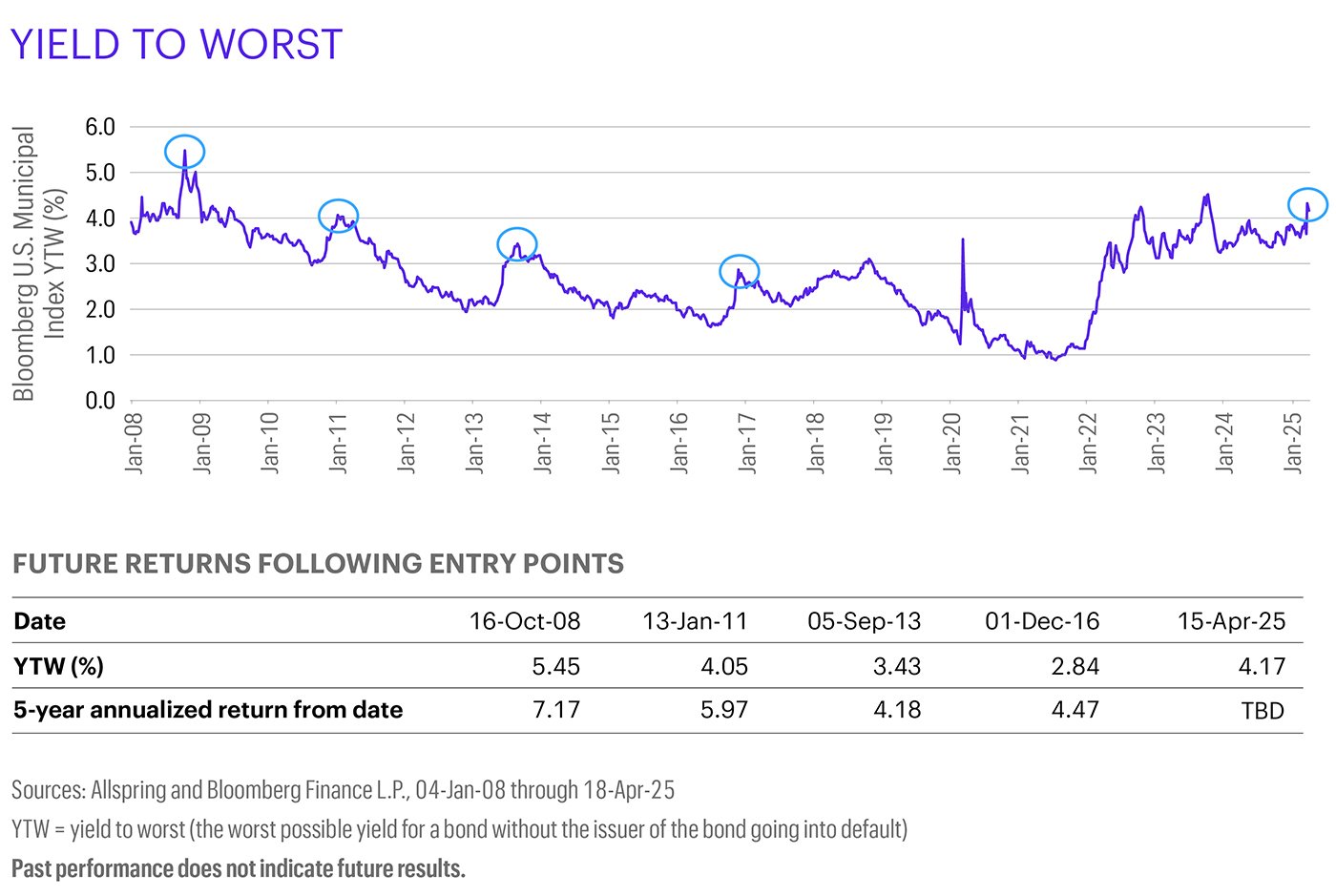

The market volatility drove municipal yields to levels we haven’t seen since the Global Financial Crisis. Just like a heavily sugared funnel cake after a terrifying roller-coaster, yields at these levels present real opportunities for investors. The chart below shows four previous entry points into the municipal market with roughly comparable yields to the current market’s. The table following the chart shows the subsequent five-year annualized returns following each of those entry points.

These compelling returns are even more so when you recognize they’re not adjusted for the tax benefit that municipal bonds can provide. For investors in the upper tax brackets, the potential to flirt with equity-like returns for muni-like risks is a possibility.

Opportunities like this don’t come around often. The chart below takes a historical look at periods when the Bloomberg Municipal Bond Index experienced a 3% or larger weekly decline. The corresponding price declines were met with a rapid increase in yields available to investors. Those yields (currently 4.29%, or a tax-adjusted 7.24% based on a 40.8% tax bracket) could potentially create a very interesting forward-looking return profile.

If there were ever a time for more funnel cake—oops, I mean municipal bonds—that time may be now.

ALL-04232025-yl35dc29