Macro Matters—Tariffs vs. Taxes: Which Will Affect Growth More?

Macro Matters provides a concise, comprehensive look at macroeconomic themes that matter to clients.

Key takeaways

- Growth: Weakening in the U.S. and internationally

- Inflation: Sticky for the moment though slower-moving items support lower core prices

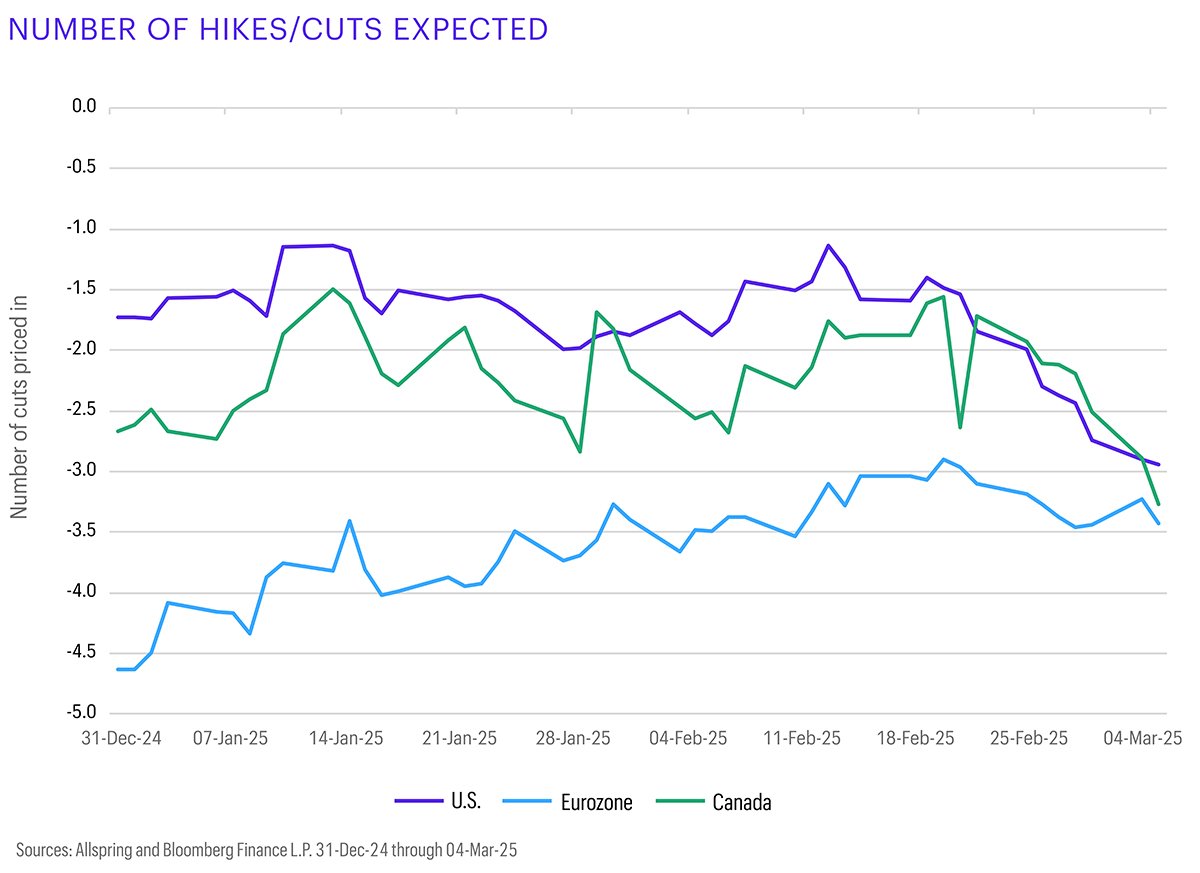

- Rates: Patient Federal Reserve (Fed) versus active international central banks

Growth: Tariffs as a growth dampener

U.S. growth has been weakening with softer services and retail sales data indicating some growth fatigue. The labor market and real income remain robust. Aggressive tariffs could dampen growth due to supply-chain uncertainty and higher import costs that, in the end, result in higher prices for consumers. Historically, the U.S. economy has managed to stay competitive through cheap commodity imports from Canada and inexpensive labor inputs from Mexico. New tariffs on those countries will likely boost U.S. costs for their products, negatively affecting the U.S. economy’s long-term competitiveness.

Internationally, weaker currencies and lower rates seem to have stabilized growth and consumer sentiment at low levels. Europe’s data remain sluggish and U.K. data have weakened following the country’s election, but consumers still benefit from rising real incomes and a stable labor market. European central banks will likely keep cutting rates through 2025 despite recent volatility in inflation indicators. Additional U.S. tariffs will likely pressure growth internationally, largely depending on the size and scope of the tariffs implemented. Tariffs on autos or pharmaceutical products currently being discussed would negatively affect Europe and parts of Asia. Regarding China, authorities have stepped up efforts to support ailing property developers, which could put a floor under property prices. Consumer sentiment remains weak, but measures to boost consumption are underway. Separately, the government seems more open to international trade after 2024’s slump in direct foreign investments, and the recent embrace of technology giants like Alibaba Group Holding Limited may indicate a more business-friendly tone.

Inflation: More patience needed

The latest U.S. inflation and producer prices readings were slightly worse than expected. However, the prices used in the Fed’s preferred inflation measure, which is consumption based, signal further moderation ahead. Based on these numbers and the consumer fatigue we’ve observed, we expect prices to gradually shift lower this year despite short-term upward pressure. Tariffs will likely be inflationary for some products, but any governmental effort to offset that through fiscal support could push prices higher more broadly, at least over the shorter term.

Outside the U.S., lower rates and weaker currencies could counteract Europe’s falling prices, although growth is so weak that it would take more rate cuts to affect inflation negatively. Seasonal factors played a role in pushing Europe’s inflation temporarily higher, but the underlying trend points downward—even in the U.K. In China, inflation was temporarily boosted by recent holidays, but it doesn’t seem to be a cure for China’s deflationary trend.

Rates: Central bank divergence to continue

We believe the Fed will stay paused on further rate cuts until May at the earliest. The Fed on hold supports long-end yields and has led to curve flattening since January. Recent weakness in the U.S. dollar (USD) may indicate weakening U.S. growth. Pressured growth could ultimately lead the Fed to ease monetary policy later in the year, and the market has already begun pricing this in. From summer onward, we expect the Fed will have a clearer economic picture and some room to lower interest rates.

International bonds have underperformed U.S. Treasury bonds since the beginning of 2025. This is due partly to over-optimism regarding international rate cuts and partly to the fact that U.S. trade tariffs haven’t yet been implemented to the degree originally announced. Europe’s expectation of needing to spend up to $3.1 trillion on defense spending for Ukraine over the coming years has also contributed to European bonds’ struggles. We expect Europe will continue lowering interest rates in 2025. Meanwhile, China has stepped up fiscal support to its construction sector and private consumption. Both Europe and China will continue adding monetary stimulus in the absence of fiscal stimulus. Deflationary trends are much more entrenched internationally than in the U.S., and sentiment—both consumer and corporate—remains low given increased political and tariff-related uncertainties.

Implications for fixed income

With increasing global trade uncertainty and central banks still cautious about adding more stimulus before inflation targets are hit, we believe bond markets should continue doing well. Yields remain attractive overall.

We believe U.S. bonds will remain supported and earn the carry. Interest rates will likely continue falling on the short end of the curve, though probably not before the third quarter of 2025. Farther out on the curve, there’s likely more interest rate volatility ahead because tariffs can potentially increase inflation through higher import prices and a possibly weaker U.S. dollar. We expect the interest rate curve to continue steepening in the second half of 2025 as the market starts rebuilding a term premium into long-maturity bonds. We favor higher-quality U.S. bonds with low- to medium-term durations that are less affected by interest rate and growth volatility.

International bonds remain supported by lower growth and inflation, although this is largely priced in already. Any negative impact on growth from trade tariffs may support higher-quality bonds, though we expect that tariffs could result in yield curve steepening and shorter-term bonds outperforming longer maturities. We’re positive on international bonds for now, though any relief from lower-than-expected tariffs or lower geopolitical risk from the Russia-Ukraine conflict could be positive for European growth. The eurozone’s recently announced fiscal spending has negatively affected both nominal yields and inflation expectations. Whether this impact continues or not will depend heavily on how the spending is implemented.

Implications for equities

We remain constructive on equities and acknowledge there might be a short-term shift away from U.S. equities toward international equities. A weaker USD and lower rates internationally combined with delayed U.S. trade tariffs has led to international equities’ outperformance. Potentially lower geopolitical risk could also boost international stock markets. Valuations aren’t cheap, but improved earnings growth could propel equities higher. Overall, we think absolute equity performance should be supported by the prospects of gradual monetary easing, fiscal stimulus through corporate tax cuts, and less aggressive tariff measures.

We expect the global equity market’s broadening to continue—including emerging markets supported by cheaper valuations, lower real rates, weaker currencies, and more Chinese stimulus. Focusing on quality and valuation remains a prudent approach for us.

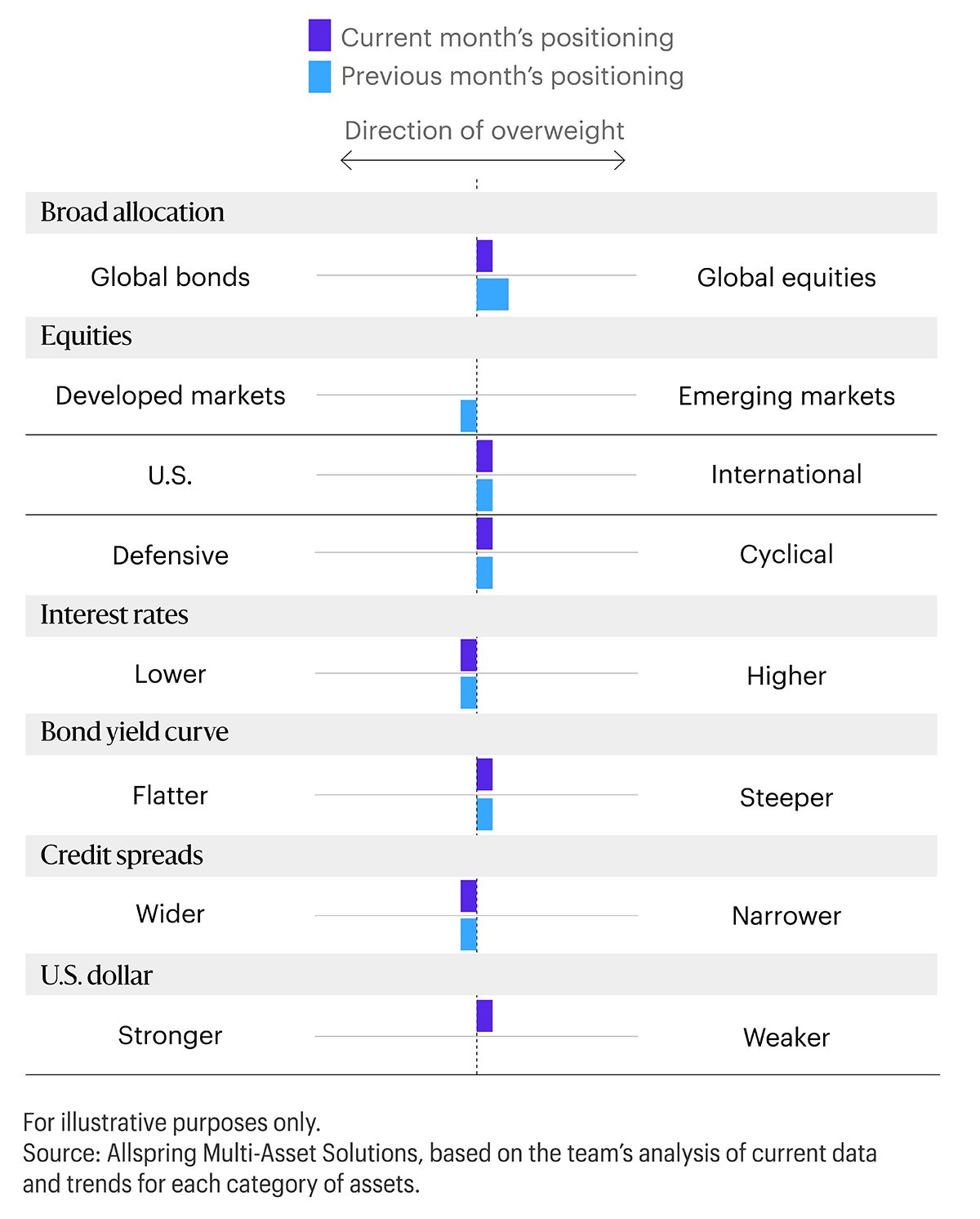

Implications for multi-asset portfolios

Since the beginning of 2025, we’ve been adding to our international equity exposure. European, emerging market, and Chinese equities could offer good diversification as the rally broadens. We continue to like bonds over cash, especially on the international side. Should concern about growth start outweighing inflation uncertainty, we may see the equity/bond correlation turn negative again. Tariff concerns will likely continue triggering short-term volatility, but we ultimately expect a less aggressive implementation. This should support equities and bonds. Currently, we favor shorter maturities because we expect a steepening yield curve in Europe. We’ve moved to a USD underweight given the increased likelihood of trade tariffs triggering negative side effects on growth and inflation.

Potential allocations based on today’s environment

The table depicts our views on short-term trends that are developed using quantitative analysis of data over the past 30 years overlaid with qualitative analysis by Allspring investment professionals. The positioning of each bar in the table shows the direction and magnitude of an overweight.

ALL-03102025-hm83nrl2