Macro Matters: More “If” Than “When” For The Fed?

Macro Matters provides a concise, comprehensive look at macroeconomic themes that matter to clients.

Download PDF

Key takeaways

- Growth: U.S. growth has slowed but is still outperforming international growth.

- Inflation: Inflation momentum in the U.S. has been on the rise, while Europe is getting closer to their inflation target.

- Rates: We expect monetary policy divergence ahead.

-

Growth: U.S. growth has slowed but is still outperforming international growth.

In the U.S., the first half of the year gave us a precursor of what is likely to continue for the remainder of the year. While both U.S. and international growth are likely to slow, we believe the speed of adjustment will be much faster in the international markets. U.S. company earnings and retail sales remain strong, supporting a strong job market. The U.S. economy has also been benefiting from strong fiscal spending, which is likely to slow further ahead of the U.S. elections. A stronger U.S. dollar, higher real interest rates, and weak external demand should gradually dampen growth in the U.S.

From an international perspective, growth data in Europe remain weak despite some recovery in first quarter growth. A cautious consumer is leading to higher personal savings rates and less spending. The manufacturing sector remains weak and a lack of fiscal stimulus and monetary stimulus has driven real gross domestic product (GDP) growth in Europe close to 0%. Through the examination of Chinese growth data, we observe domestic weakness being offset by cheap exports. Long-term bond yields have collapsed due to excess liquidity provided by the government, which is invested in bonds rather than used by strong credit demand.

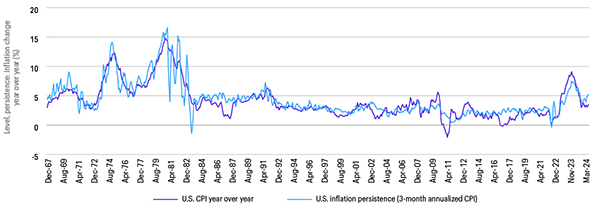

Inflation: Inflation momentum in the U.S. has been on the rise, while Europe is getting closer to its inflation target.

Sticky inflation in core prices and a diminished impact from base effects have led to higher inflation readings over the past three months, which was more than expected. The Fed’s preferred core consumption-based inflation measure is likely to make slower progress toward a 2% inflation target from the current 2.8% level. A strong labor market and higher oil prices keep U.S. inflation elevated while a stronger U.S. dollar could help dampen some of those effects via lower import costs. Inflation breadth (how widely dispersed inflation is) has stabilized while inflation stickiness (how persistent inflation is) has once again increased. With expectations of the Fed to be on hold until at least September this year, higher interest rates are anticipated to keep inflation uncertainty low for the remainder of the year.

Internationally, we are expecting a much faster convergence toward inflation targets. The eurozone is already quite close with headline Consumer Price Index (CPI) at 2.4%. Elevated rates, a moderation in trade unions, wage negotiations, and weak external demand put downward pressure on prices in Europe. The U.K. has some work to do with headline inflation at 3.2%, but we expect it will be much closer to its target rate by June. China CPI turned south again to 0.1% year over year and is expected to move into negative territory over summer.

Rates: We expect monetary policy divergence ahead.

At the beginning of the year, investors were expecting broad-based rate cuts across regions given a flurry of weaker data globally and central banks getting more comfortable with the inflation trajectory. Since then, it has been somewhat of a bumpy ride with larger rate cuts being priced out in the U.S. and, to a certain degree, also in Europe. While U.S. growth and inflation data justify a more cautious approach by the Fed in the second half of the year, it is our belief that the European Central Bank and the Bank of England will be ready to cut rates over the summer as growth expectations remain very low, consumer sentiment remains weak, and inflation is rapidly approaching central bank target levels. This is expected to lead to monetary policy divergence that is likely to benefit European bonds over U.S. Treasury bonds and result in a stronger U.S. dollar versus weaker European currencies.

U.S. CONSUMER PRICE INDEX (CPI) VERSUS U.S. INFLATION PERSISTENCE

Sources: Allspring and Bloomberg Finance L.P., December 1967 to March 2024

Implications for fixed income

Thus far in 2024, U.S. Treasury 10-year bonds are down more than 4.5%. Strong growth data and the pricing out of four to five rate cuts have led to this underperformance versus short- and medium-term bonds. European bonds fared much better, with 10-year eurozone bonds only slightly down year to date as inflation and growth data have corrected much sharper than in the U.S. In this environment, we continue to favor bonds with lower duration and a higher yield in the U.S. as well as international bonds in the eurozone that benefit from falling inflation and lower growth compared with the U.S. Later this year, once the inflation path in the U.S. becomes clearer and growth continues to slow further, longer-maturity bonds in the U.S. should benefit from their higher interest rate sensitivity as the Fed prepares to cut rates.

Implications for equities

In April, we continued to see a regional equity market divergence with international equities and especially emerging market equities outperforming. Signs of Chinese growth stabilizing and speculation about more monetary stimulus led to a positive performance of 2.5% in Chinese equities while U.S. equities lost nearly 3%. Equity markets with weaker currencies and lower interest rates in Japan and the eurozone also outperformed. One of the strongest markets was the U.K. equity market, which benefited from favorable sector exposure to energy companies and materials. We continue to make the case for a broader equity allocation this year beyond concentrated U.S. large-cap stocks into mid- and small-cap as well as international stocks. Attractive valuations, lower real rates, and weaker currencies are all supportive of their potential outperformance. We believe focusing on quality and valuation remains a prudent approach.

Implications for multi-asset portfolios

A global 60% equity/40% bond portfolio is up 1.1% year to date after giving back some performance last month on what was a very strong start to the year. Both equities and bonds corrected last month in what looked like a repeat of 2022. Most of the correction can be attributed to upward surprises in inflation and the re-rating of interest rate expectations. From a valuation perspective, bonds remain attractive mainly in the medium-term maturities and where there is an attractive yield pick-up while international equities screen positively. Momentum in bonds has turned negative since the strong rally at the end of last year, while equity momentum took a pause with last month’s correction. As we anticipate the first major central banks to possibly cut rates over summer, short-term uncertainties around monetary easing in the wake of sticky inflation are expected to persist. Given this backdrop, we expect a gradual growth slowdown to support monetary easing, supporting both bonds and equities over the medium term. We continue to expect a further broadening of the equity market rally, which may have just started in the international and emerging markets.

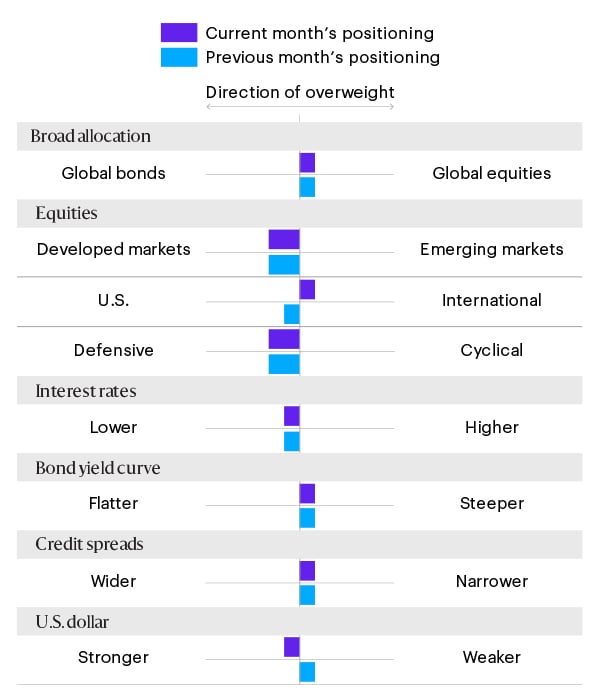

Potential allocations based on today’s environment

The table below depicts our views on short-term trends. These perspectives are developed using quantitative analysis of data over the past 30 years overlaid with qualitative analysis by Allspring investment professionals. The positioning of each bar in the table shows the direction and magnitude of an overweight.

For illustrative purposes only.

Source: Allspring Systematic Edge – Multi-Asset, based on the team’s analysis of current data and trends for each category of assets.

Related insights

This material is provided for informational purposes only and is for professional/institutional and qualified clients/investors only. Not for retail use outside the U.S. Recipients who do not wish to be treated as professional/institutional or qualified clients/investors should notify their Allspring contact immediately.

THIS CONTENT AND THE INFORMATION WITHIN DO NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO AND SHOULD NOT BE CONSIDERED INVESTMENT ADVICE, AN INVESTMENT RECOMMENDATION, OR INVESTMENT RESEARCH IN ANY JURISDICTION.

INVESTMENT RISKS: All investments contain risk. Your capital may be at risk. The value, price, or income of investments or financial instruments can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Past performance is not a guarantee or reliable indicator of future results.

Unless otherwise stated, Allspring is the source of all data (which is current or as of the date stated). Content is provided for informational purposes only. Views, opinions, assumptions, or estimates are not necessarily those of Allspring or their affiliates and there is no representation regarding their adequacy, accuracy, or completeness. They should not be relied upon and may be subject to change without notice.