Sentiment: Down for the Market, Up for Central Banks

Macro Matters provides a concise, comprehensive look at macroeconomic themes that matter to clients.

Download PDF

Key takeaways

- U.S. market sentiment toward growth has declined lately although hard data remain healthy. U.K. growth has improved, while Europe’s economy has been held back by Germany.

- U.S. and international inflation rates have continued moving toward the inflation target. China, the outlier on the downside, is experiencing very low inflation.

- The U.S. Federal Reserve (Fed) will likely lower rates for the first time in September. We expect further cuts in Europe this year as well.

Growth: More weakness ahead

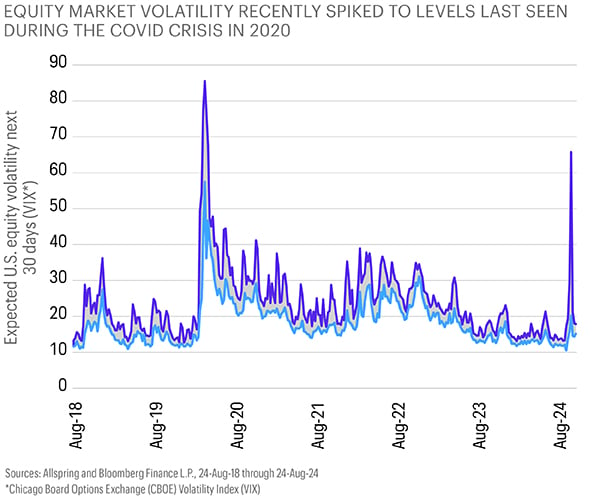

Most of August’s growth numbers pointed to a gradually slowing U.S. economy from healthy levels, and the market reacted much more sensitively to it. High interest rates in the U.S. and a rate hike by the Bank of Japan triggered further deterioration in market sentiment—leading the S&P 500 Index to experience a short-term drop of nearly 10% at one point in August, and uncertainty increased to levels last seen during the COVID crisis, as seen in the chart below.

Market sentiment recovered quickly, though, and investors focused back on fundamentals. U.S. retail sales indicated continued consumer confidence, and surveys pointed to the potential for real growth of about 2% for the third quarter. All eyes will be on the labor market, with the latest revisions to nonfarm payrolls confirming a weaker employment trend. Internationally, growth data have remained mixed with some mild signs of stabilization. U.K. second-quarter growth data was largely supported by government spending while private consumption remained weak. In Europe outside of the U.K., survey indications of Germany’s economic weakness are likely to drag European growth down. While China’s growth data appear stabilized, retail sales numbers confirm that private consumption is way below its pre-COVID trend.

Inflation: Downward trend amplified by weaker growth

The latest U.S. inflation reading confirmed our predicted downward inflation trend, with core inflation at 3.2%. While rents and food prices have slowed its decline, our inflation framework indicates the year-over-year number is likely to stabilize further. Internationally, inflation is at or very close to target. U.K. inflation is close to target. European data point to further moderation of prices after summer as wage negotiations settle at lower levels, putting less upward pressure on prices. In China, inflation remains very low. Producer prices remain negative, and consumer sentiment is very weak.

Rates: From divergence to convergence

During August, the probability of a September rate cut by the Fed shifted considerably. Markets started to price in an emergency cut of 50 bps rather than a normal starting point of a 25-bp cut. However, despite weaker growth data, the labor market remains robust, real earnings are positive, and financial conditions remain stable. We believe a 25-bp cut in September followed potentially by two more rate cuts by year-end is the most likely outcome as both growth and inflation data continue to weaken.

Outside the U.S., growth and inflation remain weaker, so more cuts are justified. The Bank of England (BoE) has joined other European central banks in cutting interest rates. While inflation is stickier in the U.K., growth is likely to remain sluggish. We believe the BoE may make one to two more cuts this year. For the European Central Bank, continued weak growth in Germany and core Europe makes it easier to cut rates possibly two to three more times by year-end.

Implications for fixed income

Conditions have become increasingly favorable for U.S. fixed income during 2024. While inflation’s pace of decline was slow, and robust U.S. growth contributed to keeping interests high, the tide has now shifted toward an environment of steady growth deceleration and lower prices. Recent equity volatility also strongly supported bond prices: The interest rate market started to price a more aggressive rate-cutting cycle for the remainder of 2024 through 2025. While we remain constructive for U.S. growth, further slowdown is likely given a weakening labor market and consumers’ shift toward spending less and saving more. This environment should support government bonds and high-quality corporate bonds. Higher-yielding bonds might experience bigger price swings from more volatile spreads, but the overall carry remains attractive as long as the U.S. economy avoids a recession. We continue favoring bonds with lower- to medium-term durations and higher quality in the U.S. that should benefit from interest rate cuts later this year.

International bonds have remained supported by low growth and inflation, and real yields have continued improving with falling inflation. We believe emerging market bonds should also benefit from a weaker U.S. dollar.

Implications for equities

Despite their recently higher volatility and downside risk over the short term, we remain constructive on equities for this year. Earnings have been mixed but generally surprised on the upside. While the information technology sector has underperformed lately, U.S. equities overall have outperformed international markets given the higher volatility in some international currencies, such as Japan’s. In terms of market impact, we expect U.S. elections will move to the forefront over the short term, primarily from a relative sector perspective. However, absolute performance will likely remain dominated by the prospects of monetary easing and the U.S. economic outlook. We expect the equity rally to continue and to broaden beyond U.S. mega caps into U.S. small caps and international equities, including emerging markets. Cheaper valuations, lower real rates, and weaker currencies all support their potential outperformance. We believe focusing on quality and valuation remains a prudent approach.

Implications for multi-asset portfolios

While bonds rallied strongly, equities corrected—although they recovered most of their losses, equities remained below previous highs. A 60% equities/40% bonds exposure, though, regained its previous high as bonds held on to gains and equities recovered. We continue to like both bonds and equities over inflationsensitive assets such as commodities. Within equities, we’ve broadened our exposure to cheaper European equities. Within bonds, we continue to prefer shorter maturities over longer ones because we expect the yield curve to steepen.

The U.S. dollar has weakened more meaningfully lately. In our view, any further weakening would strengthen the case for exposure to emerging markets in both equities and fixed income.

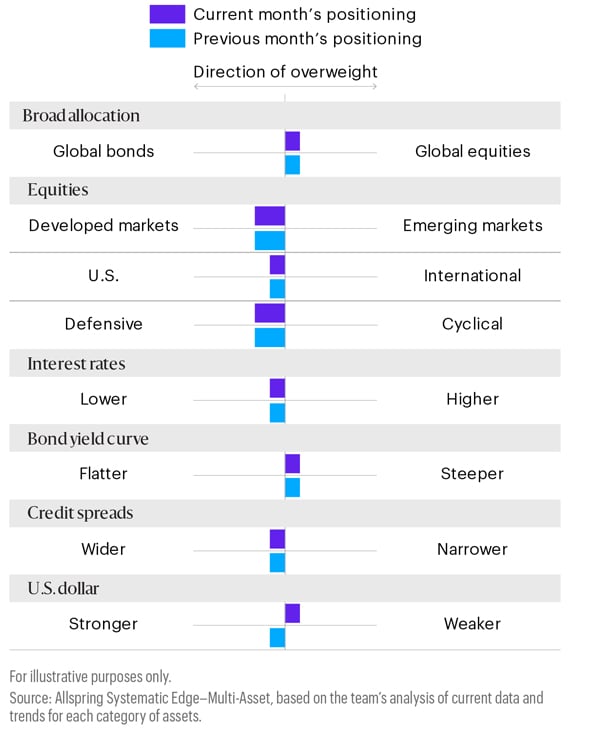

Potential allocations based on today’s environment

The table on the right depicts our views on short-term trends. These perspectives are developed using quantitative analysis of data over the past 30 years overlaid with qualitative analysis by Allspring investment professionals. The positioning of each bar in the table shows the direction and magnitude of an overweight.