EUR Investment Grade Credit Fund

+$0.33 / +0.31%

1-day change

The fund seeks total return, maximising investment income whilst preserving capital, by investing at least two-thirds of its assets in investment-grade euro-denominated credit debt securities.

Key differentiators

- Focuses on stable-to-improving European credits and structures with attractive yield profiles

- Implements a flexible benchmark-aware rather than benchmark-centric approach to focus on less efficient sectors of the market

- Leverages a seasoned and stable team that has experienced multiple credit cycles and regime shifts

- Uses a proprietary ESGiQ (ESG Information Quotient) rating system to capture key issues that may be mispriced

General facts

ISIN

LU2843028346

Bloomberg

ALEIGSU LX

Minimum investment

$

Fund inception date

6/19/2017

Share class launch date

7/15/2024

Annual management fee

0.20%

Total expense ratio (TER)

0.35%

(as of 8/31/2024)

Benchmark name

ICE BofA Euro Corporate Index (EUR)

Settlement

T+2

Performance

Past performance is not indicative of future results.

Prices, yields and distributions

Historical prices

| YTD high | $105.18 | 2/10/2025 |

| YTD low | $103.08 | 1/14/2025 |

| 52-week high | $105.18 | 2/10/2025 |

| 52-week low | $100.00 | 7/15/2024 |

| 2024 high | $104.91 | 12/11/2024 |

| 2024 low | $100.00 | 7/15/2024 |

| Best quarterly return | 0.00% | |

| Worst quarterly return | 1.24% | 12/31/2024 |

| Best annual return | - | |

| Worst annual return | - |

The distribution yield is based on the actual distributions paid by the fund. The distribution yield is calculated by summing the fund’s distributions over the preceding 12 months and dividing that figure by the applicable share price at the end of the period.

Composition

Portfolio statistics

Portfolio statistics

(as of 1/31/2025)| Fund | Benchmark | |

|---|---|---|

| Number of Holdings | 284 | - |

| Number of Issuers | - | - |

| Effective Duration | - | - |

| Weighted Average Effective Maturity | - | - |

| Average Credit Rating | A- | A- |

| Average Maturity | - | - |

| Credit Spread Duration | - | - |

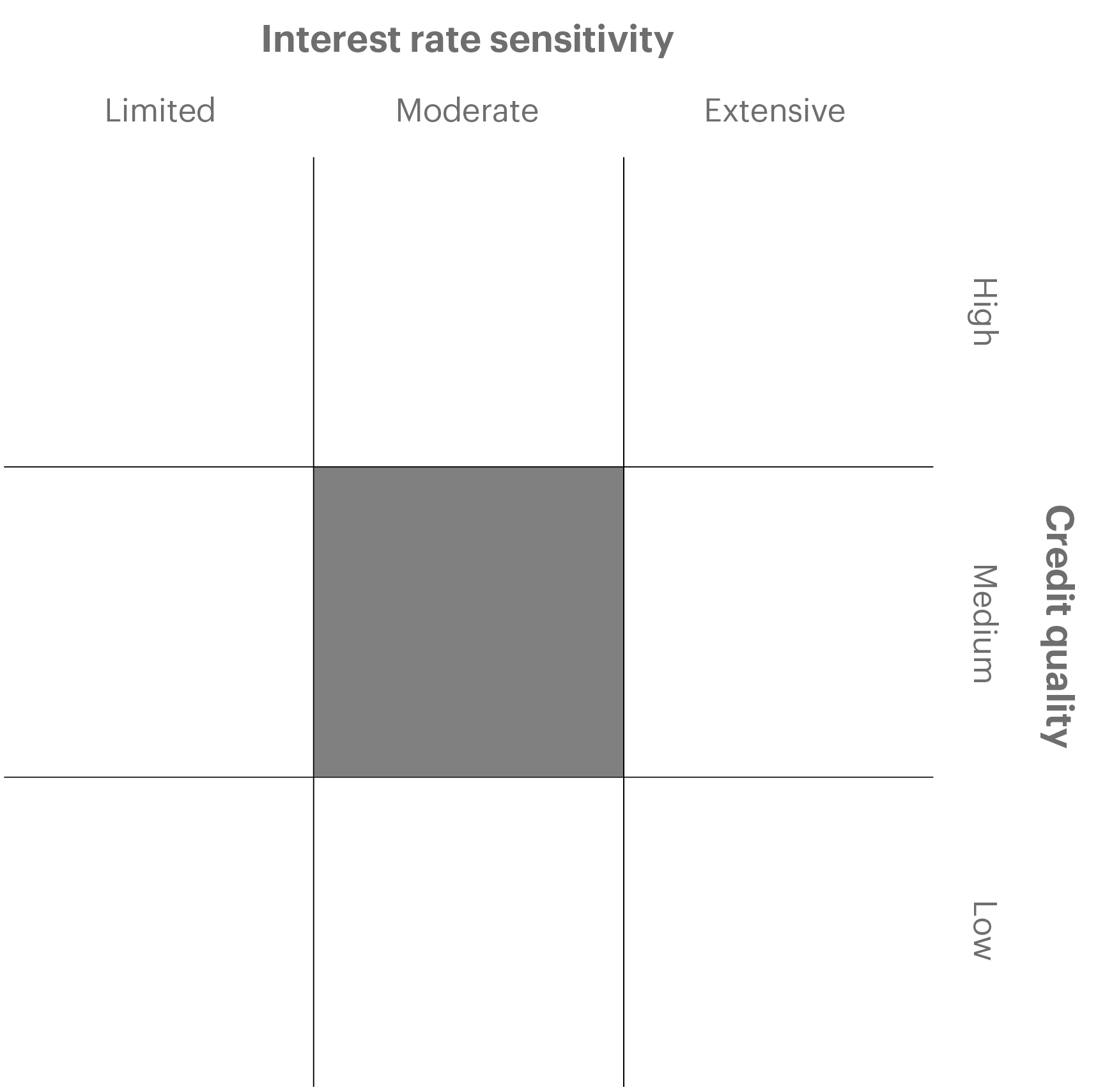

Fixed Income Style Box

(as of 1/31/2025)

Placement within the Morningstar Fixed-Income Style Box™ is based on two variables: the vertical axis shows the credit quality of the long bonds owned and the horizontal axis shows interest rate sensitivity as measured by a bond's effective duration. For credit quality, Morningstar combines the credit rating information provided by the fund companies with an average default rate calculation to come up with a weighted average credit quality. The weighted average credit quality is currently a letter that roughly corresponds to the scale used by a leading NRSRO. Bond funds are assigned a style box placement of low, medium, or high based on their average credit quality. Funds with a low credit quality are those whose weighted average credit quality is determined to be less than BBB-, medium are those less than AA- but greater or equal to BBB-, and high are those with a weighted average credit quality of AA- or higher. When classifying a bond portfolio, Morningstar first maps the NRSRO credit ratings of the underlying holdings to their respective default rates (as determined by Morningstar’s analysis of actual historical default rates). Morningstar then averages these default rates to determine the average default rate for the entire bond fund. Finally, Morningstar maps this average default rate to its corresponding credit rating along a convex curve. For municipal bond funds, Morningstar also obtains from fund companies the average effective duration. In these cases static breakpoints are used. These breakpoints are as follows: (i) Limited: 4.5 years or less; (ii) Moderate: more than 4.5 years but less than 7 years; and (iii) Extensive: more than 7 years. In addition, for non-U.S. taxable and non-U.S. domiciled fixed-income funds, static duration breakpoints are used: (i) Limited: less than or equal to 3.5 years; (ii) Moderate: greater than 3.5 years and less than or equal to 6 years; and (iii) Extensive: greater than 6 years.

Credit quality

Credit quality

(as of 1/31/2025)|

Type

|

Fund

|

Benchmark

|

|---|---|---|

|

AAA/Aaa

|

2.90% | 0.58% |

|

AA/Aa

|

11.31% | 12.81% |

|

A/A

|

40.75% | 44.98% |

|

BBB/Baa

|

41.95% | 40.35% |

|

BB/Ba

|

0.80% | - |

|

Cash & equivalents

|

2.73% | - |

The ratings indicated are from Standard & Poor's, Fitch Ratings Ltd., and/or Moody's Investors Service. The percentages of the fund's portfolio with the ratings depicted in the chart are calculated based on total investments of the fund. If a security was rated by all three rating agencies, the middle rating was used. If rated by two of three rating agencies, the lower rating was used, and if rated by one of the agencies, that rating was used. Credit quality is subject to change and may have changed since the date specified. Percent total may not add to 100% due to rounding.

Maturity

Maturity

Holdings

Top 10 Holdings

(as of 1/31/2025)|

Security

|

Fund

|

|---|---|

|

Government of Germany

|

2.00%

|

|

DNB Bank ASA

|

1.33%

|

|

BMW International Investment BV

|

1.12%

|

|

MSD Netherlands Capital B.V.

|

1.03%

|

|

Reckitt Benckiser Treasury Services Plc

|

0.91%

|

|

Zurcher Kantonalbank

|

0.82%

|

|

Svenska Handelsbanken AB

|

0.81%

|

|

Bankinter SA

|

0.80%

|

|

UBS AG London Branch

|

0.80%

|

|

Morgan Stanley

|

0.79%

|

Based on ending weights as of month-end. Source: FactSet. The information shown is not intended to be, nor should it be construed to be, a recommendation to buy or sell an individual security.

Geographic allocation

Geographic allocation

Currency allocation

Currency allocation

(as of 1/31/2025)|

Currency

|

Share Class

|

Benchmark

|

|---|---|---|

|

British pound

|

0.10% | - |

|

Cash & equivalents

|

2.73% | - |

|

Euro (EUR)

|

97.49% | - |

|

U.S. dollar (USD)

|

0.12% | - |

Currency allocation is subject to change and may have changed since the date specified. Percent total may not add to 100% due to rounding.

Portfolio Composition

Portfolio composition

ESG data summary

Product involvement 3

| Portfolio | Benchmark | |

|---|---|---|

| Controversial Weapons exposure | 0.00% | 0.55% |

| Oil Sands exposure | 0.00% | 0.00% |

| Small Arms exposure | 0.00% | 0.18% |

| Thermal Coal exposure | 0.00% | 0.75% |

| Tobacco exposure | 0.00% | 0.75% |

| UN Global Compact non-compliant exposure | 0.00% | 0.27% |

¹ Data is sourced from MSCI ESG Research where companies are rated on a scale of 0 – 10 (0 - worst, 10 - best). Weighted average scores exclude effects of unrated securities.

² ESG Risk Ratings measure exposure to and management of ESG risks. Lower risk scores reflect less ESG risk. Sustainalytics ESG Risk Scores measure ESG risks on a scale of 0 – 100 (0 - no ESG Risk, >40 - Severe ESG Risk).

³ Carbon emissions includes operational and first-tier supply chain greenhouse gas emissions. Data sourced from S&P Trucost Limited.

⁴ Source: Allspring Global Investments. This report contains information developed by Sustainalytics. Such information and data are proprietary of Sustainalytics and/or its third-party suppliers (Third Party Data) and are provided for informational purposes only. They do not constitute an endorsement of any product or project, nor an investment advice and are not warranted to be complete, timely, accurate or suitable for a particular purpose. Their use is subject to conditions available at https://www.sustainalytics.com/legal-disclaimers. Copyright © 2023 Sustainalytics. All rights reserved.

Documents

The team employs a sector specialist model whereby tenured investment professionals are supported by rigorous credit research to source opportunities across global fixed income markets.

Key risks

Contingent convertible bonds risk: These instruments can be converted from debt into equity because of the occurrence of certain predetermined trigger events including when the issuer is in crisis resulting in possible price fluctuations and potential liquidity concerns.

Currency risk: Currency exchange rates may fluctuate significantly over short periods of time and can be affected unpredictably by intervention (or the failure to intervene) by relevant governments or central banks, or by currency controls or political developments.

Debt securities risk: Debt securities are subject to credit risk and interest rate risk and are affected by an issuer’s ability to make interest payments or repay principal when due.

Asset-backed securities risk: Asset-backed securities may be more sensitive to changes in interest rates and may exhibit added volatility, known as extension risk, and are subject to prepayment risk.

High yield securities risk: High yield securities are rated below investment grade, are predominantly speculative, have a much greater risk of default and may be more volatile than higher-rated securities of similar maturity.

ESG risk: Applying an ESG screen for security selection may result in lost opportunity in a security or industry resulting in possible underperformance relative to peers. ESG screens are dependent on third-party data and errors in the data may result in the incorrect inclusion or exclusion of a security.

Geographic concentration risk: Investments concentrated in specific geographic regions and markets may be subject to greater volatility due to economic downturns and other factors affecting the specific geographic regions.

Global investment risk: Securities of certain jurisdictions may experience more rapid and extreme changes in value and may be affected by uncertainties such as international political developments, currency fluctuations and other developments in the laws and regulations of countries in which an investment may be made.

Leverage risk: The use of certain types of financial derivative instruments may create leverage which may increase share price volatility.

Investors should note that, relative to the expectations of the Autorité des Marchés Financiers, this fund presents disproportionate communication on the consideration of non-financial criteria in its investment policy.

The ongoing charges/total expense ratio (TER) reflects annual total operating expenses for the class, excludes transaction costs and is expressed as a percentage of net asset value. The figure shown is from current KID. The investment manager has committed to reimburse the Sub-Fund when the ongoing charges exceed the agreed upon TER. Ongoing charges may vary over time.

Any benchmark referenced is for comparative purposes only, unless specifically referenced otherwise in this material and/or in the prospectus, under the Sub-Funds’ Investment Objective and Policy.

†Promotes environmental and social characteristics but does not have a sustainable investment objective

†While the Sub-Funds listed above have access to both internal and external ESG research and integrate financially material sustainability risks into their investment decision-making processes, ESG-related factors are considered but not determinative, permitting the relevant Sub-Investment Managers to invest in issuers that do not embrace ESG; as such, sustainability risks may have a more material impact on the value of the Sub-Fund’s investments in the medium to long term. The investments underlying these Sub-Funds do not take into account the EU criteria for environmentally sustainable economic activities.

The Morningstar Rating™ for funds, or star rating, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar risk-adjusted return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales loads. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its 3-, 5-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% 3-year rating for 36–59 months of total returns, 60% 5-year rating/40% 3-year rating for 60–119 months of total returns, and 50% 10-year rating/30% 5-year rating/20% 3-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent 3-year period actually has the greatest impact because it is included in all three rating periods. Past performance is no guarantee of future results.

© 2024 Morningstar. All rights reserved. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.